vermont income tax refund

Vermont State Income Tax Forms for Tax Year 2021 Jan. To request an extension to file your federal taxes after May 17 2021 print and mail Form 4868 Application for Automatic Extension of Time To File US.

Details on how to only prepare and.

. If you file a. This form is only. Call 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-statefor information on the status of your return and refund.

Commissioner Craig Bolio Deputy Commissioner Rebecca Sameroff. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

State Of Nj Income Tax Refund Information in Piscataway NJ. Tax Return Preparation Taxes-Consultants Representatives. To check the status of your.

For questions about your health insurance or. See How Long It Could Take Your 2021 State Tax Refund. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. Vermont Income Taxes. My Tax Refund Express.

Then click Search to find your refund. Name A - Z Sponsored Links. Vermont State Tax Refund Status Information.

Federal State Income Tax NJ. Vermont State Income Tax Return forms for Tax Year 2021 Jan. Extensions - A 6-month extension is available to extend the filing of a Vermont income tax return by filing Form IN-151 - Application for Extension of Time to File Form IN-111.

Open enrollment for 2023 plans begins November 1 2022. The refund date youll see doesnt include the days your financial institution may take to process a direct deposit or the time a paper check may take to arrive in the mail. The 2022 state personal income tax brackets.

31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date. YEARS IN BUSINESS 718 833-2066. Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter.

You can also contact Vermont Health Connect by phone at 1-855-899-9600 or online. Find out when your Vermont Income Tax Refund will arrive. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets.

Rates range from 335. Of Vermont but you earned more. Click on Check the Status of Your Return Personal Income Tax Return Status.

Check For The Latest Updates And Resources Throughout The Tax Season.

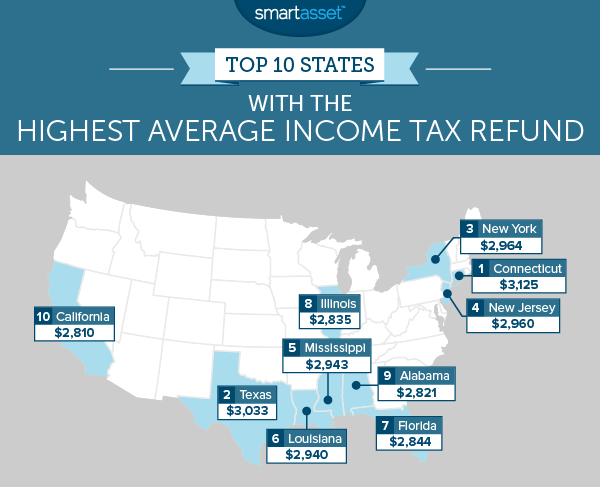

The Average Tax Refund In Every State Smartasset

The Average Tax Refund In Every State Smartasset

State Income Tax Rates Highest Lowest 2021 Changes

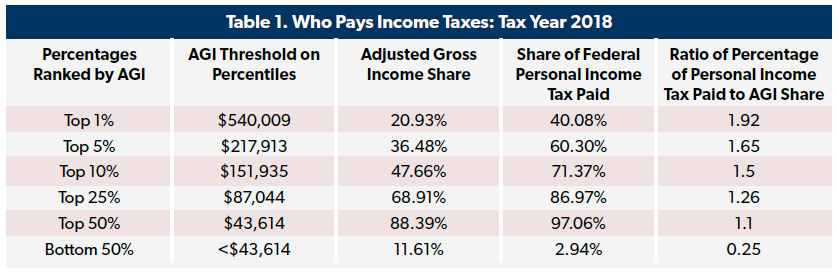

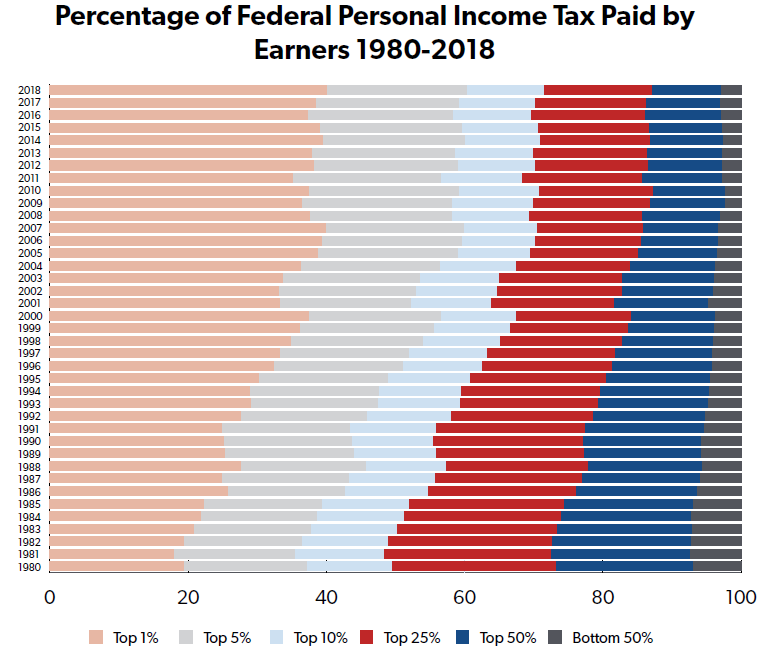

Who Pays Income Taxes Tax Year 2018 Foundation National Taxpayers Union

Who Pays Income Taxes Tax Year 2018 Foundation National Taxpayers Union

School Cover Letter How To Write A School Cover Letter Download This School Cover Letter Template Now Cover Letter Template Lettering Lettering Download

Jansport Virginia Tech Shirt Tech Shirt Jansport Shirts

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine

State Corporate Income Tax Rates And Brackets Tax Foundation

Irs Owes Taxpayers More Than 1 Billion In Unclaimed Tax Refunds Tax Refund Income Tax Return Irs

Pin By Shari A Clark On Student Inventory Adjusted Gross Income Income Reconciliation

Will The Irs Extend The Tax Deadline In 2022 Marca

Tax Credit Tax Credits Tax Help Tax

Tax Prep Tax Preparation Income Tax Preparation

Education Tax Credits And Deductions Can You Claim It Tax Credits Educational Infographic Education

States With No Income Tax H R Block

Where S My State Refund Track Your Refund In Every State

Who Pays Income Taxes Tax Year 2018 Foundation National Taxpayers Union